Encashment of Earned Leave is a facility available to Central Government employees through which they can convert earned leave into monetary benefits.

The Central Government provides many types of leaves to its employees and one of these Earned Leave is very important for central government employees.

Table of Contents

Other than Earned Leave, the important leaves available to Central Government employees are- Half Pay Leave, Commuted Leave, Maternity Leave, Paternity Leave, Extraordinary Leave, Child Care Leave, Casual Leave. Apart from these leaves, there are also some leaves which are available to Central Government employees in special cases.

But the Earned Leave is most important leave because government employee can encash Earned Leaves as per their eligibility and requirement. Earned Leave is available to all central government employees without any term and condition.

Central government employees can avail the benefit of encashment of earned leave in two ways. Firstly, they can encash earned leave with Leave Travel Concession and secondly, they can encash the unutilized earned leave at the time of retirement.

In this article, we are going to explain in detail what is earned leave and how Encashment of Earned Leave can be availed.

Also read: Leave Travel Concession for Government Employees: Important Rules Calculate Salary of a Government Employee as per 7th CPC

What is Earned Leave

Earned Leave is also called Privilege Leave and a government employee earns as he works for a specified number of days.

Earned Leaves are credited in advance on the 1st of January and 1st of July every year. The number of Earned Leave credited in advance is 15 days for six months i.e. 15 days Earned Leave for 1st January to 30th June and 15 days for 1st July to 31st December. So, a central government employee earns 30 Earned Leaves every year and these leaves are credited to his leave balance.

The maximum number of earned leave for the entire service period of a Central Government employee is 300 i.e. Earned Leave can be accumulated up to 300 days only. These 300 leaves are in addition to the leave encashed by the employee during the service period.

Encashment of Earned Leave or EL Encashment

As per Leave Encashment rules for central government employees, a government employee can take cash in lieu of his Earned Leave balance and this is called Encashment of Earned Leave or generally EL encashment.

Two types of encashment of Earned Leave can be taken by a Government servant- 1. Encashment of Earned Leave during Leave Travel Concession and 2. Encashment of Earned Leave on retirement

Encashment of 10 days Earned Leave for LTC

A government employee can avail encashment of Earned Leave during Leave Travel Concession or LTC maximum number of 60 days in the entire career.

As per 10 days leave encashment rules for central government employees, he can avail encashment of 10 days Earned Leave for LTC. He may encash for both types of Leave Travel Concession i.e. Home Town LTC and Anywhere in India.

But he can only avail encashment of 10 days Earned Leave for LTC when there is 30 days of EL balance at his credit after deducting the total number of Earned Leave he is taking and number of leave applied by him for availing encashment.

If the government servant availed encashment for Earned Leave but does not avail the Leave Travel Concession for any reason within prescribed time then he has to refund the total amount of leave encashment. Also he has to pay interest at the rate of interest allowed on Provident Fund plus two per cent.

After refunding the encashment of Earned Leave and paying interest the number of leaves he had applied for encashment, is credited back to his leave balance.

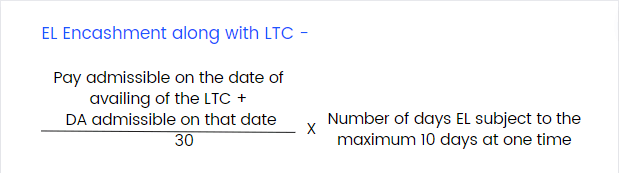

EL encashment calculation-

Encashment of Earned Leave on retirement

As per rules of leave encashment on retirement for central government employees, an employee is eligible for getting lumpsum cash in lieu of Earned Leave at his credit at the time of retirement or quitting of service.

But he can avail leave encashment for maximum number of 300 Earned Leave including Half Pay Leave. He will get leave salary and Dearness Allowance only as the lumpsum amount. It does not consist Home Rent Allowance or any other Special Allowance.

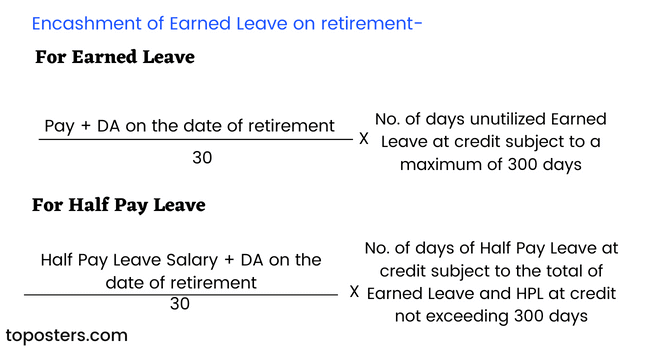

Encashment of earned leave on retirement calculation-

At the time of retirement a government employee will get cash equivalent of his Earned Leave in the following manner- a) For Earned Leave- Pay + DA on the date of retirement divided by 30 and multiply by No. of days unutilized Earned Leave at credit subject to a maximum of 300 days b) For Half Pay Leave- Half Pay Leave Salary + DA on the date of retirement divided by 30 and multiply by No. of days of Half Pay Leave at credit subject to the total of Earned Leave and HPL at credit not exceeding 300 days

Conclusion

A government employee earns 15 days leave for every six months i.e. 2.5 leave in a month. Since this type of leave are earned by government employee so this is called Earned Leave.

On 1st January and 1st July of every year, 15 Earned Leaves are credited to his leave balance in advance. In his entire service he can accumulate up to 300 Earned Leave.

A government employee can get cash in lieu of his earned leave at the time of availing Leave Travelling Concession. Also at the time of retirement he will get a lumpsum amount for maximum number of 300 earned leave.

So, in view of the above, we can say that Earned Leave is most important leave for a government employee.

Frequently Asked Questions-

What is encashment of Earned Leave?

A government employee can take cash in lieu of his Earned Leave balance and this is called Encashment of Earned Leave or generally EL encashment.

How many earned leaves can be encashed?

A government employee can avail leave encashment for maximum number of 300 Earned Leave including Half Pay Leave.

How to calculate encashment of earned leave?

EL Encashment along with LTC –

(Pay admissible on the date of availing of the LTC + DA admissible on that date) divided by 30 and multiply by 10

Encashment of Earned Leave on retirement-

Pay + DA on the date of retirement divided by 30 and multiply by No. of days unutilized Earned Leave at credit subject to a maximum of 300 days

Will earned leaves expire?

A maximum of 300 Earned Leaves can be accumulated in the leave account of a government employee. If the earned leaves credited after this amount of leave are not availed, then they expire automatically.

Can El and CL be combined?

No, Earned Leave and Casual Leave cannot be combined.

How many leave days are earned per month?

2.5 Earned Leave in a month i.e. 30 Earned Leaves are credited to leave account of a government employee in a year.

How many El can be taken at a time?

A government employee can avail maximum up to 180 days earned leave at a time. But in some cases Group ‘A’ and Group ‘B’ officers can avail more than 180 days but not exceeding 300 days at a time.

How many earned leave in a year?

30 days as Earned Leave are credited to a central government employee’s leave account in advance, in two installments of 15 days each on the first day of January and July of every calendar year.

Comments are closed.