SSC Tax Assistant Salary, Job Profile and Promotion: Most of the aspirants preparing for SSC CGL want to know the Tax Assistant Salary, what are the promotion opportunities and Job Profile of a Tax Assistant in CBIC or CBDT.

Summary about GST Tax Assistant Salary / Income Tax Assistant Salary

Table of Contents

- 1. What is the post of SSC CGL Tax Assistant?

- 2. Tax Assistant Salary Slip

- 3. How to become Tax Assistant in CBDT and CBIC

- 4. SSC CGL Tax Assistant Salary

- 4.1. Tax Assistant Grade Pay and Pay Band

- 4.2. Tax Assistant Salary as per 7th Pay Commission

- 4.3. Calculation of SSC CGL Tax Assistant Salary

- 5. Tax Assistant Promotion

- 6. SSC CGL Tax Assistant Job Profile

- 7. Tax Assistant Transfer and Posting

- 8. Conclusion

- 9. FAQs about SSC CGL Tax Assistant Salary

| Post Name | Tax Assistant |

| Group of Post | Group ‘C’ (Non-gazetted) |

| Exam for Tax Assistant | SSC CGL (Combined Graduate Level) Exam |

| Department | CBIC (Central Board of Indirect Taxes & Customs) and CBDT (Central Board of Direct Taxes) |

| Tax Assistant Grade Pay | 2400/- |

| Tax Assistant Basic Pay (7th CPC) | Rs. 25,500 to 81,100 |

| Gross Salary (X class cities) | Rs.47,043/- (including HRA) |

| Gross Salary (Y class cities) | Rs.42,264/- (including HRA) |

| Gross Salary (Z class cities) | Rs.38727/- (including HRA) |

Tax Assistant Job Profile means a description of the tasks and responsibilities that a Tax Assistant working in CBIC or CBDT is expected to perform i.e. what a Tax Assistant will be doing in a specific role.

Also aspirants are curious about to know that what are the promotion opportunities for a Tax Assistant post in CBIC or CBDT.

In this blog post we will explain about all these things in respect of a SSC CGL Tax Assistant i.e. SSC CGL Tax Assistant Salary, Promotion opportunities and Job profile working in CBIC (Central Board of Indirect Taxes and Customs) and CBDT.

But first you should know that the candidates who get selected as Tax Assistant in CBIC are posted in GST or Customs office.

When a candidate is preparing for any exam, he thinks more about the post with higher salary. But due to some reasons if he does not get selected for higher post like Inspector, yet he should collect all information about that lower post for which he is selected.

Therefore, this article will be more beneficial for those candidates who have been selected for the post of Tax Assistant and they want to know what is the SSC CGL Tax Assistant salary, job profile and promotion opportunities in this cadre.

Also read- > GST Inspector Salary as per 7th CPC, Job Profile and Promotion > Inspector and Tax Assistant Job profile in CBDT and CBIC

Also they should be aware of that can they prepare for other examination while working as Tax Assistant in GST or Customs office.

In this article we have provided detailed information about Tax Assistant Salary, Job profile and promotion opportunities in CBIC.

But first, we will talk about that what is the post of Tax Assistant under CBIC.

What is the post of SSC CGL Tax Assistant?

The post of Tax Assistant in CBDT(Central Board of Direct Taxes) and CBIC(Central Board of Indirect Taxes and Customs) is of clerk grade.

This post is equivalent to Upper Divisional Clerk. That is, it is a ministerial post and not an executive post and it comes under Group C.

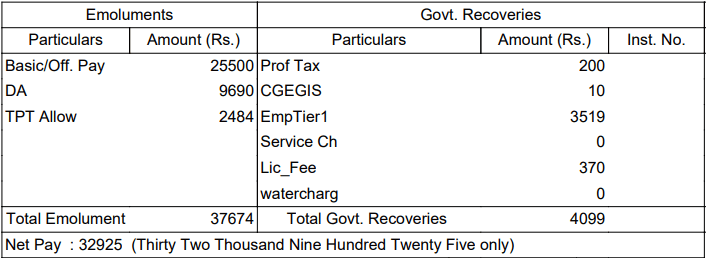

Tax Assistant Salary Slip

Here you can see a sample Tax Assistant Salary Slip. It is downloaded from pfms and it is authentic. This Tax Assistant Salary Slip is of a tax assistant who lives in a government quarter in Y class city, so home rent allowance has not been added to his gross salary.

How to become Tax Assistant in CBDT and CBIC

To become a Tax Assistant in CBDT and CBIC, a candidate has to clear the CGL exam conducted by Staff Selection Commission.

As per new Exam Pattern of SSC CGL, there are two Tiers in this examination viz – Tier-I and Tier-II. After qualifying Tier-I and Tier-II examination, a candidate is selected for the post according to the marks he has scored and cut off marks for the post.

Multiple choice type questions are asked in the examinations from Tier-I and Tier-II. The candidate who appears for the post of Tax Assistant has to appear in Tier-II only for Paper-I.

To know the full details about SSC CGL New Exam Pattern, read this post – SSC CGL New Exam Pattern.

Merit list is prepared by adding the marks of Tier-I and II after qualifying the Typing Test.

If you achieve the prescribed cut-off for the post of Tax Assistant, then your selection is done for this post.

If you clear CGL exam with good marks then you can get placement at your preferred place. So try to score 35-40 marks more than the cut off.

Keep in mind that the cut-off for the post of Tax Assistant in CBDT is higher as compared to CBIC.

SSC CGL Tax Assistant Salary

Tax Assistant Grade Pay and Pay Band

Tax Assistant in CBDT and CBIC is a Group ‘C’ Non-gazetted post. Tax Assistant Grade Pay is Rs.2400/- and the Pay Band is Rs.5200-20200.

Tax Assistant Salary as per 7th Pay Commission

If we look at the Pay Matrix of the Seventh Pay Commission, then we see that the Grade Pay Rs.2400/- comes under Pay Level 4 and Cell 1. That is, the Entry Basic Pay of a Tax Assistant will be Rs. 25500/-. That means, the Basic Pay of a newly appointed Tax Assistant is Rs.25500/-

Now we will calculate a SSC CGL Tax Assistant salary on Basic Pay Rs.25500/-.

Here we are assuming that the said Tax Assistant has been posted in any X class city. Since, some allowances vary according to the class of city in which he is posted.

So now let’s calculate the SSC CGL Tax Assistant salary working in CBIC and CBDT.

Calculation of SSC CGL Tax Assistant Salary

First we will calculate some important allowances which are the part of salary of any government employee. We have given important information about these allowances in another article.

So, all allowances calculation will be done on Basic Pay of Rs.25500/-

DA(Dearness Allowance)

This is the most important part of salary of a government employees. Presently, the rate of DA is 38%.

Hence, the DA on Basic Pay Rs.25500/- is 38% of 25500/- = Rs.9690/-

Transport Allowance (TPTA)

Transport Allowance is provided to government employees for commuting from home to office. This allowance varies as per Pay Level and class of city.

As already we have told that the Basic pay of a Tax Assistant comes under Pay Level 4 and Cell 1. Hence, in X class city, Transport Allowance for a GST Tax Assistant is calculated as below-

Transport Allowance of a central government employee with Pay Level 3 to 8 and working in X class city is = 3600+ 3600 x Current DA = 3600+38% of 3600 = Rs.4968/-

If that Tax Assistant is posted in any city other than the 19 cities with high TPTA rates, then the Transport Allowance he gets will be directly halved. It means, the TPTA he will get is 1800+ 38% of 1800 = Rs.2484/-. This amount is equal to the half of Rs.4968/-.

HRA (Home Rent Allowance)

Those government employees who do not stay in government quarters are paid HRA as a part of salary.

Presently, eligible government employees are getting HRA at the rate of 9%, 18% and 27% of Basic Pay for X, Y and Z class city respectively.

Here, we will calculate HRA for Tax Assistant who is working in X class city.

Hence, the HRA is 27% of Rs.25500/- = Rs.6885/-

So, the SSC CGL Tax Assistant salary (Gross) = Basic Pay + DA + TPTA + HRA = 25500 + 9690 + 4968+ 6885 = 47043/-

The calculation of SSC CGL Tax Assistant Salary is shown in the table below for convenience.

Tax Assistant Salary in X class city

| Basic Pay | 25500 |

| Dearness Allowance | 9690 |

| Transport Allowance | 4968 |

| Home Rent Allowance | 6885 |

| Gross Salary | 47043 |

Tax Assistant Salary in Y class city

| Basic Pay | 25500 |

| Dearness Allowance | 9690 |

| Transport Allowance | 2484 |

| Home Rent Allowance | 4590 |

| Gross Salary | 42264 |

Tax Assistant Salary in Z class city

| Basic Pay | 25500 |

| Dearness Allowance | 9690 |

| Transport Allowance | 1242 |

| Home Rent Allowance | 2295 |

| Gross Salary | 38727 |

There are two important things to note while calculating salary of any government employee.

Firstly, Gross Salary is not credited to the account of any government employee. Some amount is deducted from their salary as government and non-government deductions.

The government deductions are like Pension Deduction (NPS), CGHS, CGEGIS etc. and the non-government deductions are like Professional Tax etc.

After subtracting these deductions from Gross salary the net salary is credited to employee’s bank account.

Secondly, if that Tax Assistant is staying in Government Quarters then he is not paid HRA and his salary will be calculated without HRA.

Tax Assistant Promotion

Promotion of Tax Assistant in CBDT and CBIC is either in the line of Ministerial Cadre or in the line of Executive Cadre.

First promotion

The first promotion of Tax Assistant is to the post of Senior Tax Assistant in both CBDT and CBIC departments. It is now also known as Executive Assistant.

This first promotion of Tax Assistant in Ministerial Cadre is considered very good. Because with this promotion there is a significant jump in the rank and salary of Tax Assistant.

While the post of Tax Assistant comes in Group C, the post of Senior Tax Assistant becomes Group B. Also the Grade Pay increases from Rs.2400/- to Rs.4200/-. This increases the salary by approximately Rs.15000/-.

Senior Tax Assistant grade pay- Rs.4200/- Senior Tax Assistant salary (approx) - Rs.60,000/-

Also, we can see a good increment in the amount of allowances received by a Senior Tax Assistant. Some of the allowances he receives are equal to that of Inspectors.

Promotion of Tax Assistant to the post of Senior Tax Assistant in CBDT is done in 3 years. In CBIC also this promotion used to be done in first 3 years only but due to new recruitment rules, now this promotion will be done in 10 years.

A Tax Assistant has to clear the departmental examination to get promoted to the post of Senior Tax Assistant. There are 4 to 5 papers in this departmental examination in which questions related to office work, CCS Conduct Rules, GST Rules are asked.

A GST Tax Assistant gets promoted to the post of Senior Tax Assistant / Executive Assistant after clearing this exam.

Second promotion

Also, the second promotion of Tax Assistant becomes very important. Because at this stage there are two cadre to get promotion options. First in the Executive Cadre and second in the Ministerial Cadre.

So before taking the next promotion at this stage, any Senior Tax Assistant should think about his future in the department and then take a good decision.

Promotion to Executive Cadre

When a Senior Tax Assistant clears the departmental examination for the next promotion, he/she gets promoted to the rank of Inspector.

This post comes in Executive Cadre and its Grade Pay increases to Rs.4600/-.

In the matter of promotion to this post, the position of both the CBDT and CBIC departments is almost the same.

Promotion of a Senior Tax Assistant to the post of ITI (Income Tax Inspector) in CBDT takes place in about 4 to 5 years. Whereas according to the new recruitment rule in CBIC, this promotion will now be done in 5 years.

Promotion to Ministerial Cadre

In this cadre, a Senior Tax Assistant in CBDT is promoted to the post of Office Superintendent. Its Grade Pay is also equal to the Grade Pay of an Inspector (CBIC and CBDT) which is Rs.4600/-.

In CBIC, this promotion happens as an Administrative Officer. This post (AO) comes in Group B ‘Gazetted’ and its Grade Pay is Rs. 4600/-.

Promotion to higher posts

The next promotion of Income Tax Inspector in CBDT is to the post of Income Tax Officer. Pay Scale of ITO is same as Pay Scale of Inspector 9300- 34800/- but Grade Pay increases to 4800/- and this post becomes Gazetted.

The next promotion of ITO is to the post of Assistant Commissioner. Who comes in Group A. In further promotion, there is promotion to the post of Deputy Commissioner, Joint Commissioner.

But for promotion to these posts, it is necessary to get the job of Tax Assistant at the right time. Also, after getting the job, passing the departmental examination from time to time.

The promotion of an Inspector in CBIC is also similar to that of Inspector in CBDT. The only difference is that in CBDT, an Inspector is promoted to ITO and in CBIC to the post of Superintendent.

The subsequent promotions to Superintendent are the same as the promotions to ITO in CBDT.

In the ministerial cadre, an administrative officer is promoted to the post of Chief Accounts Officer. This post comes under Group A.

In this way you can see that the opportunities for promotion in the Executive Cadre of a Tax Assistant are more than the opportunities for promotion in the Ministerial Cadre.

SSC CGL Tax Assistant Job Profile

Here Job Profile means what kind of work a Tax Assistant has to do in the office.

There is a slight difference in the job profile of Tax Assistant in CBDT and CBIC.

In CBDT, the Tax Assistant has to do some work on the executive side. Such as checking income tax returns, calculating the tax liability of companies and individuals, viewing applications related to PAN, maintaining tax demand lists and issuing notices, etc.

The work of Clerical Grade of Tax Assistant is same in both CBDT and CBIC departments. Keep in mind that in CBIC, Tax Assistant is not given the work of executive side.

A Tax Assistant in the Clerical Grade (both in CBDT and CBIC) has to do the following mainly in three sections- Administration Section, Establishment Section and Accounts Section-

To make salary bill of all the employees of the office and calculate their income tax.

Settlement of claims made by those employees like Medical claim, Traveling Allowance claim, LTC claim and other types of claims.

Submission of applications relating to their leave before the competent authority for acceptance.

Maintaining and up-to-date service book of employees.

To conduct the work related to administration in the office. Like maintaining the office as well as purchasing essential goods in the office and distributing it among the employees for office purposes.

To conduct work related to establishment like transfer/posting work of employees, forward any representation received from them etc.

Preparation of Monthly and Quarterly Reports.

Apart from the above tasks, other tasks given by senior officers from time to time are also dealt with by a Tax Assistant.

Tax Assistant Transfer and Posting

The posting of a Tax Assistant is often in the headquarters or in such a division where at least 10 to 15 employees are working.

There is no posting of Tax Assistant in an office where 3 or 4 Executive staff (Inspector / Superintendent) are working.

Since the posting of Tax Assistant is always at non-sensitive places, there is no special provision for their transfer.

A Tax Assistant can work in the same office for years if he wants, but if he wants to transfer to another office, then he has to give a representation to his controlling officer for this.

If the controlling officer does not have any problem in transferring that Tax Assistant, then he is given posting at his desired place.

Conclusion

If you want to work in CBIC as GST Tax Assistant and for some reason you are not selected for the post of Inspector, then the job of Tax Assistant is also a better option. Because SSC CGL Tax Assistant Salary is also not so bad.

This job is also a good option for those candidates who want to do table work while staying in the office. Because no kind of field work is given to any Tax Assistant.

As far as promotion is concerned, at present the promotion of a Tax Assistant in CBDT is better than that of CBIC. If the first promotion in CBDT is available within 3 years, then in CBIC, it will now have to wait for 10 years.

Zonal transfer is also good in CBDT as compared to CBIC.

So if you have been selected for the post of Tax Assistant in CBIC, then try to prepare again to get the post of Inspector or at least get the post of Tax Assistant in CBDT.

In CBDT, if you clear the departmental exams at the right time, then at the time of retirement you will be in a good position.

If you liked the above information, then definitely share it with your friends preparing for SSC and also benefit them. Sharing is Caring.

FAQs about SSC CGL Tax Assistant Salary

What is the starting salary of SSC CGL Tax Assistant?

The post of Tax Assistant comes under 2400 Grade Pay. As per the 7th CPC Pay Matrix, the entry Basic Pay of a Tax Assistant is Rs.25500. If a Tax Assistant is posted in an X Cclass city then on the basis of this Basic Pay he gets around Rs.30000 per month. This is starting SSC CGL Tax Assistant Salary.

What is the salary of SSC CGL income tax officer?

Tax Assistant Salary in Income Tax Department is approx. Rs.42000/- and Income Tax Inspector Salary is approx. Rs.65000/-. These salaries are including Home Rent Allowance as per X class city.

Is Tax Assistant a group C post?

Yes, SSC CGL Tax Assistant comes under Group C post.

Is Tax Assistant a good job?

The job of SSC CGL Tax Assistant is also good and the salary of about 30 thousand rupees is also decent. But according to the new recruitment rule, now the first promotion of a tax assistant will be done after 10 years. Thus, considering the time taken in promotion, it is no longer an attractive post for SSC CGL aspirants.

Is tax Assistant a clerk?

Yes, the post of Tax Assistant is a clerical post.

Is tax assistant a gazetted officer?

No, Tax Assistant is a clerical post and comes under Group C.

What is the role of tax assistant?

Tax Assistants selected in SSC CGL are posted either in CBDT or in CBIC. There is a slight difference between job profile of a tax assistant working in CBDT and CBIC. But most of the tax assistants have to work in admin, establishment or account section only.

Comments are closed.