Curious about the Income Tax Inspector Salary in 2024? This guide has all the info you need. We cover everything from their starting salary to how they can progress in their career.

In this article we have given information about SSC CGL Income Tax Inspector Salary as per 7th CPC. Also we have given detailed information about the promotion and job profile of Income Tax Inspector.

Table of Contents

- 1. Income Tax Inspector Salary as per 7th CPC

- 2. Income Tax Inspector salary in hand

- 3. Income Tax Inspector salary slip

- 4. What is Income Tax Inspector?

- 5. How to become an Income Tax inspector in CBDT?

- 6. Income Tax Inspector qualification

- 7. Income Tax Inspector Job Profile

- 8. Income Tax Inspector working hours

- 9. Income Tax Inspector Promotion and Career Growth

- 10. Income Tax Inspector Transfer Policy

- 11. Income Tax Inspector uniform

- 12. Conclusion

- 13. Income Tax Inspector Salary FAQs

Whether you are a new graduate thinking about a job in public service or just curious about this role, we have got you covered. Let’s dive into the details of Income Tax Inspector salaries in 2024.

First, here we are giving brief information about the Income Tax Inspector Salary-

| Designation | Income Tax Inspector |

| Group of ITI | Group ‘C’ (Non-Gazetted) |

| Examination | SSC CGL (Combined Graduate Level) Exam |

| Department | CBDT (Central Board of Direct Taxes) |

| Grade Pay of Income Tax Inspector | 4600/- |

| Basic Pay | Rs.44900 to 142400 |

Income Tax Inspector Salary (Including HRA) in X Class City – Rs.82,933/- , in Y Class City – Rs.76,264/- and in Z Class City – Rs.72,223/-

Now let us know in detail about Income Tax Inspector Salary, Job profile and Promotion opportunities.

You may also like:-

| GST Inspector Salary, Job Profile and Promotion Opportunities |

| SSC CGL Tax Assistant Salary, Job Profile an Promotion Opportunities |

Income Tax Inspector Salary as per 7th CPC

You know, the Grade Pay, Pay Band and Pay Scale of all the posts under SSC CGL exams are given in the Notification.

Now, the salary of all government employees is calculated according to the Pay Matrix of 7th Pay Commission.

In the 7th CPC Pay Matrix, the Pay Scales are given according to all Grade Pay and on the basis of that Pay Scale we will calculate Income Tax Inspector Salary.

If you want to learn how to calculate the salary of a government employee, then read this article-

Income Tax Inspector Grade Pay – According to the 6th Pay Commission, Income Tax Inspector post was under the Pay Band of Rs.9300-34800 and Grade Pay Rs.4600/- i.e. the Grade Pay of Income Tax Inspector is Rs.4600/-.

To calculate the newly appointed Income Tax Inspector Salary, first we will know his Entry Basic Pay based on the Pay Matrix of the Seventh Pay Commission.

As per Pay Matrix of 7th Pay Commission, Basic Pay for this post is Rs. 44900 to 142400. That is, its entry comes in Basic Pay, Level 7 and Cell 1. In this way the Entry Basic Pay of an Income Tax Inspector will be – Rs.44900/-.

On the basis of this Basic Pay i.e. 44900/- we will calculate the salary of a newly appointed Income Tax Inspector.

First of all, we consider the Place of Posting of that Income Tax Inspector. Because some allowances like Home Rent Allowance and Transport Allowance, received by a government employee vary according to the city.

Here we are going to calculate Income Tax Inspector salary who is posted in an X class city.

Let’s start to calculate the Income Tax Inspector Salary on the basis of Basic Pay Rs.44900/- for X class city.

Calculation of Income Tax Inspector Salary

Basic Pay = 44900/-

DA(Dearness Allowance) = 50% of 44900/- = 22450/- As currently DA is 50%).

Transport Allowance (TPTA) = Transport Allowance for an employee of Pay Level 3 to 8 for X Class City = 3600+ 3600 x Current DA = 3600+3600 x 50% = 5400/-

HRA (Home Rent Allowance) = 44900/- का 27% = 12123/-

Gross Salary = Basic Pay + DA + TPTA + HRA = 44900 + 22450+ 5400 + 12123 = Rs.84873/-

For your convenience, here we are providing Income Tax Inspector Salary in table format-

For X Class City

| Component | Amount |

|---|---|

| Basic Pay | 44900 |

| Dearness Allowance | 22450 |

| Home Rent Allowance (HRA) | 12123 |

| Transportation Allowance (TPTA) | 5400 |

| Gross Salary | 84873 |

For Y Class City

| Component | Amount |

|---|---|

| Basic Pay | 44900 |

| Dearness Allowance | 22450 |

| Home Rent Allowance (HRA) | 8082 |

| Transportation Allowance (TPTA) | 2700 |

| Gross Salary | 78132 |

For Z Class City

| Component | Amount |

|---|---|

| Basic Pay | 44900 |

| Dearness Allowance | 22450 |

| Home Rent Allowance (HRA) | 4041 |

| Transportation Allowance (TPTA) | 2700 |

| Gross Salary | 74091 |

Income Tax Inspector salary in hand

As we have mentioned in an article that Gross Salary is not credited to the bank account of any government employee. After some Government and Non-Government deductions from this Gross Salary, the Net Salary is received by that employee.

Major Government Deductions are – Pension Deduction (NPS Tier-I), CGHS, CGEGIS, Professional Tax etc. and Non-Government deductions like Quarters Association and Water Charges (if IT inspector lives in Government Quarters) etc.

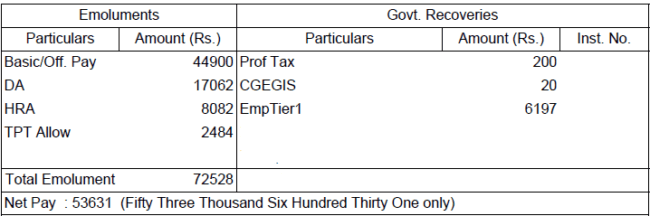

Income Tax Inspector salary slip

Here we are giving a sample of Income Tax Inspector salary slip which is downloaded from PFMS. This is a sample of salary slip of Income Tax Inspector posted in a Y class city.

Income Tax Inspector is promoted to the post of Income Tax Officer and his Grade Pay increases from Rs.4600/- to Rs.4800/-. After getting promotion, his Pay is fixed according to the Pay Matrix of 7th Pay Commission and then Income Tax Officer salary is calculated.

As you can see, Income Tax Inspector Salary consists the following three major allowances-

House rent allowance or HRA –

House rent allowance or HRA is given to any government employee in lieu of paying house rent. It is available to those government employees who live in a rented house outside instead of any Government Quarters.

The HRA current rate is 27% for X Class city, 18% for Y Class city and 9% for Z Class city respectively. So if an Income Tax Inspector is working in an X Class city then he will get Rs.12123/- as HRA, Rs.8082/- for Y Class city and Rs.4041/- for Z Class city.

Dearness Allowance –

Dearness Allowance is an allowance given to government employees to reduce the effect of inflation on their income and to adjust their standard of living. It is given at a fixed rate and is calculated as a percentage of the basic pay of an employee. The percentage of DA may be revised periodically based on inflation rates.

Currently the DA rate is 46% and it remains fixed for all cities. On this basis, the Dearness Allowance received by an Income Tax Inspector will be Rs.20654/-.

Transport Allowance (TPTA) –

Transport Allowance is provided to the government employees in lieu of the expenses of commuting between their residence and place of work. It varies according to the pay level of the employees and the category of cities. There are 19 cities in India which come under the category of Higher Transport Allowance. The Transport Allowance available in the remaining cities is half of the Transport Allowance available in the said 19 Higher Transport Allowance cities.

If an Income Tax Inspector is working in a city categorised as Higher Transport Allowance, then the Transport Allowance he will get will be Rs.3600 + DA(thereon) and for the rest of the cities Rs.1800 + DA(thereon).

Other benefits and allowances available to the Income Tax Inspector:

Apart from the above allowances such as HRA, DA, TPTA, Income Tax Inspector is provided the following benefits-

• 30 litre petrol for field posting

• Official SIM card with limited mobile bill

What is Income Tax Inspector?

Income Tax Inspector is a prestigious job in India which attracts many candidates every year. Income Tax Inspectors play an important role in the Tax collection system in India. They enforce the provisions of the Income Tax Act and ensure compliance of tax laws by individuals and organizations.

Income Tax Inspectors are government employees and work under the Central Board of Direct Taxes (CBDT) and collect revenue for the government.

The post of Income Tax Inspector comes under Group ‘C’ under CBDT (Central Board of Direct Taxes). This is a non-gazetted post.

Now let us know how to become Income Tax Inspector in CBDT.

How to become an Income Tax inspector in CBDT?

To become Income Tax Inspector in CBDT, you have to qualify Combined Graduate Level Exam conducted by Staff Selection Commission.

To prepare for SSC CGL exam, it is very important to know about its pattern and syllabus. For this you can read these articles- SSC CGL Exam Pattern , SSC CGL Exam Syllabus

As mentioned in the first article, according to SSC CGL Exam Notification 2022, now there will be only two Tier i.e. phases in this exam.

Multiple choice type questions are asked in Tier-I and Tier-II examinations. A candidate appearing for the post of Income Tax Inspector has to appear only for Paper-I in Tier-II and also appear for Typing Test on the same day.

As per the new exam pattern of SSC CGL Exam, Tier-I is of qualifying nature only. Its marks will not be added in making the final merit list. Thus the final merit list will be prepared on the basis of marks obtained by the candidate in Paper-I of Tier-II.

If you get the prescribed cut-off for the post of Income Tax Inspector in CBDT, then you are selected for this post.

After that the allotment of State/Zone is done on the basis of marks obtained and preferences given by you.

Income Tax Inspector qualification

To become an Income Tax Inspector, the candidate must have graduation degree. He has passed graduation in any subject and with any percentage of marks then can appear in SSC CGL exam. There is no restriction on marks obtained in graduation.

Income Tax Inspector Job Profile

CBDT i.e. Central Board of Direct Taxes is responsible to collect Direct Taxes such as Income Tax, Corporate Tax and Wealth Tax.

Income Tax Inspectors working in CBDT are backbone in the Indian tax system and help the department in the collection of these Direct Taxes. There are two types of job profiles of Income Tax Inspectors – one is desk job and the other is field job. Hence, you can say the responsibility of working of Income Tax Inspectors depends on their posting.

According to the job profile given above, Income Tax Inspectors is posted in any one of the two sections-

- Assessment Section

- Non-Assessment Section

Assessment postings usually have more discretionary powers than non-assessment postings.

Functions of Income Tax Inspector in Assessment Section

Income Tax Inspector mainly handles all the desk jobs in the Assessment Section. Some of the important functions are as follows-

- To assess income tax of individuals, companies, partnership firms liable to pay income tax.

- To manage the works related to TDS (Tax Deduction at Source).

- Handling tasks related to Refund claims

If an Income Tax Inspector working in this section is in any Investigation wing and on any search duty, then he may have to work on weekends as well. Thus, in this section, an Income Tax Inspector has to deal with lots of work.

Functions of Income Tax Inspector in Non-Assessment Section

An Income Tax Inspector working in the Non-Assessment Section usually has to do clerical type work. In this section he has to handle the following work-

- Related to TDS, HR, Training etc. at Judicial postings and Headquarters

- Filing of Official paperwork

- Sometimes go with a raid team

Income Tax Inspector working hours

The working hours of Income Tax Inspector in the Income Tax Department are generally fixed like any Indian government job. The working time of Income Tax Inspector is from 9 am to 5.30 pm.

But the working hours of the Income Tax Inspector working in the Non-Assessment section are sometimes vary according to work load. Because when they go on a raid or search, their regular working hours for duty may increase. Sometimes they may have to work continuously for 2 to 3 days without any leave or sometimes they do not get leave even in weekends. Likewise, they may need to work more during tax filing season.

Income Tax Inspector Promotion and Career Growth

As already mentioned that SSC CGL Income Tax Inspector is a Group C post. But once you become an Income Tax Inspector in CBDT, you reach the post of Group A by getting promoted from time to time.

So, the future of an Income Tax Inspector in CBDT is very bright. He may get many promotions in his service period. If you become an Income Tax Inspector at early age, then you will retire from a very good position.

The order of promotion of an Income Tax Inspector is as follows- >Income Tax Inspector > Income Tax Officer (ITO), (group “B” Gazetted) >Assistant Commissioner >Deputy Commissioner >Joint Commissioner >Additional Commissioner >Commissioner of Income Tax

Generally, It takes about 6 to 7 years to become an Income Tax Officer. But the promotion may vary from zone to zone or state.

Income Tax Inspector Transfer Policy

Income Tax Inspector working in CBDT has two types of Transfer Policies which are as follows-

AGT( Annual General Transfer)

It is a regular transfer that happens every year. That is, Establishment Orders are issued every year for the transfer of Inspectors in CBDT. But under AGT, an Income Tax Inspector is usually transferred after 2 or 3 years from one station to another station. The zone of Income Tax Inspector is not changed during AGT. In the same zone he is transferred from one office to another office.

ICT(Inter Charge Transfer)

A newly recruited Income Tax Inspector gets posting only in a certain zone. If he wants to change his zone then he can apply for change of zone under Inter Charge Transfer. If the department accepts his request, then will be transferred from his current zone to requested zone.

But it is to be noted that if he is transferred to a new zone under ICT on request, he loses all his seniority.

Generally, if an Income Tax Inspector is in a big city, then up to the rank of Income Tax Officer (ITO) he can work in the same city. On promotion to the rank of ITO, he is generally transferred to another station/city within the same zone. After a few years, he/she may request for his/her transfer to the earlier station/city.

When he is promoted from Income Tax Officer to the post of Assistant Commissioner (Group “A” ) of Income Tax, he compulsorily has to be transferred to another zone. But after working in that zone for a few years, he can again request for transfer to his previous zone.

Income Tax Inspector uniform

No uniform has been prescribed by the Government of India for Income Tax Inspector. Whether he is working in the office or on field duty, such as inspection or raid, he does not need to wear any kind of uniform.

Conclusion

In this article you read that SSC CGL Income Tax Inspector Salary ranges from approximately Rs.72000/- to 82000/- as per 7th Pay Commission which depends on the city.

The post of Income Tax Inspector comes under Group ‘C’ in CBDT (Central Board of Direct Taxes). This is a non-gazetted post.

To become an Income Tax Inspector in CBDT, you have to clear the Combined Graduate Level Exam conducted by the SSC. SSC CGL Exam consists of two stages viz Tier-1 and Tier-2. To become an Income Tax Inspector, a candidate must be a graduate in any discipline.

Promotion of Income Tax Inspector is very good. If you once become an Income Tax Inspector in CBDT, then by getting promoted from time to time, you reach the post of Group A i.e. you become IRS.

Income Tax Inspector Salary FAQs

What is the salary of income tax inspector?

The Basic Pay of a newly appointed Income Tax Inspector is Rs.44900/-. On the basis of this Basic Pay, the gross salary including all allowances of an Income Tax Inspector is Rs.79053/- in X class city, Rs.72528/- in Y class city and Rs.67245/- in Z class city.

Does Income Tax Inspector get car?

No, an Income Tax Inspector gets Transport Allowance every month for commuting from home to office and 30 litres of petrol every month for official duty.

Is Income Tax Inspector a gazetted officer?

No, Income Tax Inspector is a Group “C” Non-gazetted post. Later he gets promoted and becomes a Group “A” officer.

What is the qualification for Income Tax Inspector?

To become an Income Tax Inspector, you must have passed graduation in any discipline.