Want to know how to calculate the salary of a Government Employee as per 7th CPC? Whether you are preparing for a government job or are already serving, understanding your pay is crucial. The 7th Pay Commission Pay Matrix can seem complicated, often leaving many unsure how their salary is structured based on their pay level.

While job notifications often mention the pay scale or pay level, they don’t always explain how the actual monthly salary is calculated. Since the implementation of the 7th Central Pay Commission (CPC), government employee salaries are calculated using the Pay Matrix Table – but many aspirants find it confusing.

Table of Contents

Don’t worry, In this article, you will learn:

7th CPC Salary Calculator, 2025 for Central Govt. Employees

Before calculating salary, it is important to know what is Pay Level and where does it come from?

What is Pay Level and Pay Scale / Download 7th Pay Matrix Table PDF

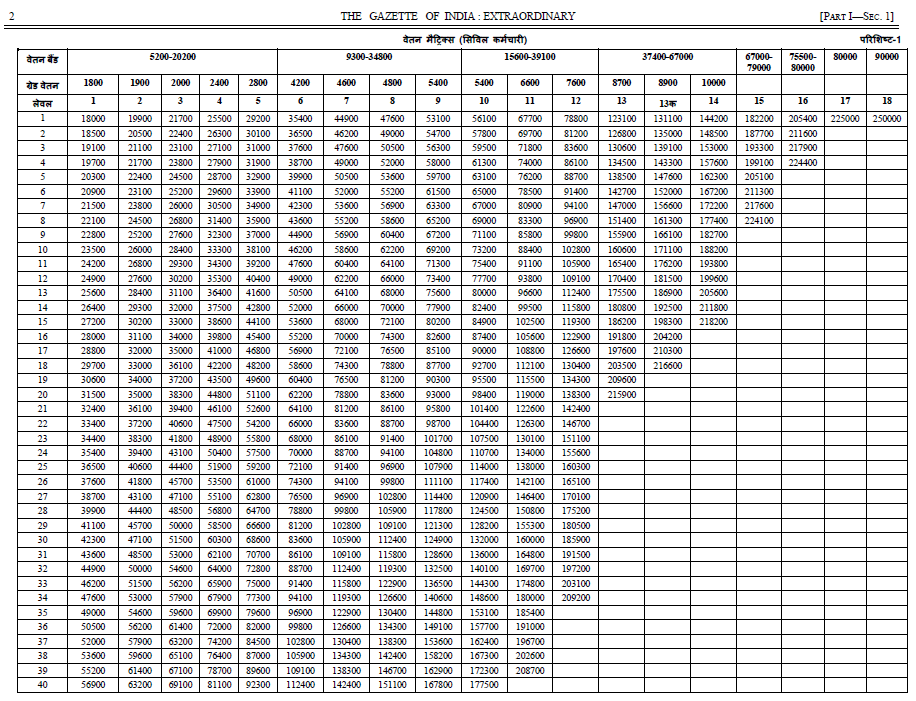

When the Central Government implemented the 7th Pay Commission in 2016, the pay matrix was introduced.

Pay levels are decided according to this Pay Matrix. Pay Level replaced the existing Grade Pay. Therefore, Grade Pay is the base for deciding the Pay Level of a government post in the Pay Matrix.

Download 7th CPC Pay Matrix PDF

There are 18 Pay Levels in the Pay Matrix as per the above picture and all these Pay Levels are placed according to the Grade Pay.

As 1800 Grade Pay is in the first Pay Level, 1900 Grade Pay is in the Second Pay Level and similarly as the Grade Pay is increasing the Pay Level is also increasing.

So now you must have understood what is Pay Level.

Now we will tell to calculate Salary on the basis of this Pay Level.

Calculate Salary of a Government Employee as per 7th CPC

Calculating the salary of a government employee in India can be a complex process, as it involves a number of different factors and components. In this blog post, we will go through the steps involved in calculating the salary of a government employee in India, so that you can better understand your own salary or the salary of someone you know.

So, first we will tell you about the components that are included in calculating the salary of a government employee-

Pay Scale

The first step in calculating the salary of a government employee in India is to determine the pay scale. The pay scale refers to the range of salaries that a government employee can receive, based on their position and qualifications.

For example, if a government employee is at the “Pay Level 7” as per 7th CPC Pay Matrix, his Basic Pay will be between Rs. 44,900 and Rs. 1,42,400, while if a government employee is at the “Pay Level 8”, his Basic Pay will be between Rs. 47,600 and Rs. 1,51,100 as per 7th CPC.

Basic Pay

The basic pay is the salary that a government employee receives before any additional allowances or deductions are applied.

Once you have determined the Pay Scale of a government employee, the next step is to find the basic pay as per 7th CPC Pay Matrix.

To find the basic pay, you need to refer the 7th CPC Pay Matrix. Again we take the above example, i.e. if a government employee is at the “Pay Level 7” as per 7th CPC Pay Matrix, his Basic Pay will be between Rs. 44,900 and Rs. 1,42,400.

Allowances

In addition to the basic pay, a government employee may also receive a number of allowances, which are additional payments made to cover specific expenses.

Some common allowances for government employees in India include House Rent Allowance (HRA), Dearness Allowance (DA) and Travel Allowance (TA).

To calculate these allowances, you will need to refer to the relevant rules and regulations, as the amount of each allowance can vary depending on the employee’s location and other factors.

Deductions

Finally, you will need to calculate any deductions that are taken from the employee’s salary. These might include tax deductions, as well as deductions for things like insurance premiums or retirement contributions.

To calculate these deductions, you will need to refer to the relevant rules and regulations, as the amount of each deduction can vary depending on the employee’s salary and other factors.

Gross Salary

There are mainly four types of Pay and Allowances under this-

1. Basic Pay 2. HRA 3. DA and 4. TA

Now we will calculate the per month salary of a government employee based on the above components.

For this, we will first choose a grade pay as an example and accordingly we will determine the pay scale in 7th CPC pay matrix.

We will take 4600 Grade Pay as an example to calculate Salary here.

To calculate Salary, we first divide it into two parts – first is Gross Salary and second is Deductions.

The salary that the Government Employee gets is called Net Salary. Generally, Net Salary is also called In-hand Salary.

When deductions are subtracted from Gross Salary, then Net Salary is obtained i.e. Net Salary = Gross Salary – Deductions

Now what is this Gross Salary and what are Deductions, let us now take information about it.

Now let’s take information about them one by one.

Basic Pay

For checking Basic Pay of an employee we refer Pay Matrix.

Since we are assuming 4600 Grade Pay as an example here. So we will find Pay Level of 4600 Grade Pay in Pay Matrix.

As we can seen, in the Pay Matrix, the Pay Level of 4600 Grade Pay is 7.

Now we will see the Basic Pay of the First Cell of Pay Level 7 which is 44900. In this way we see that the basic pay of the one who is selected for the post 4600 Grade Pay will be Rs.44900/-.

An overview of Pay Matrix also shows that this Basic Pay ranges from 44900 to 142400. This means that every year the Basic Pay reaches from 44900 to 142400 by taking increments.

Well it is impossible that the Basic Pay of an employee will go from 44900 to 142400. Because his promotion will happen before reaching there and he will reach the next Pay Level i.e. 8.

Home Rent Allowance (HRA)

The full form of HRA is – Home Rent Allowance.

There are two situations for this. First, if you live in Government Quarters, then HRA will not be added to your salary. That is, HRA will not be added while calculating Gross Salary.

The second situation is that you are not living in the Government Quarters, that is, if you have not occupied it, then HRA will be added to your Gross Salary.

If you do not live in Government Quarters, then how much HRA you will get depends on the category of city your office is located in.

As it is known that on the basis of HRA, the central government has divided Indian cities into three categories – X, Y and Z.

As per 7th Pay Commission HRA in X category city is 27% of Basic Pay . There is 18% in Y category city and 9% in Z category.

We will give detailed information about HRA in another article.

At present, let us assume for example that your office is located in y category city then you will get 18% of HRA Basic Pay. We have already determined the Basic Pay 44900/- so HRA will be – 18% of 44900 i.e. Rs.8082/-

In this way we came to know two things- Basic Pay and HRA

Now the third one is DA. So let’s calculate DA now.

Dearness Allowance (DA)

The full form of DA is – Dearness Allowance . Nowadays most of the people are well aware of this word. This allowance is given by the government in lieu of increasing inflation.

Although the central government announces it twice every year, but in special circumstances, the central government can also stop the increase in DA. This happened last year due to Corona crisis.

At present the rate of DA is 38%. So here in our example, DA will be 38% of Basic Pay i.e. 38% of 44900 = Rs.17062/- (This DA rate is effective from 1 July 2022)

This is the same for all Government Employees working in any department in India.

Now it is the turn to calculate TA.

Transport Allowance (TA)

Its full form is – Transport Allowance. It is clear from the name that it is given to the Government Employee in lieu of the cost of transportation.

Its calculation is a bit tricky. For this, two things have to be kept in mind. First what is the Pay Level of the Employee and second, in which Category of City he is posted.

As per 7th Central Pay Commission, the following rates of Transport Allowance is admissible to the Central Government Employees-

| Pay Level of Employee | Posted in Cities with Higher rates of Transport Allowance | Posted in other cities |

|---|---|---|

| 9 and above | Rs.7200 + DA thereon | Rs.3600 + DA thereon |

| 3 to 8 | Rs.3600 + DA thereon | Rs.1800 + DA thereon |

| 1 and 2 | Rs.1350 + DA thereon | Rs.900 + DA thereon |

Click here to see the OM relating to grant of Transport Allowance to Central Government Employees.

Here we are taking Basic Pay 44900 as an example, whose Pay Level is 7 and also assuming that the Employee is posted in any city other than the city with high TA rates, then his TA will be calculated in the following way –

Current DA of 1800 + 1800

Presently the DA rate is 38%. So TA will be- 38% of 1800+1800 = 2484/-

In this way our TA got Rs. 2484/-.

Now we can calculate gross salary.

Gross Salary = Basic Pay + HRA + DA + TA

We have got all these four things from the above example.

Basic Pay = 44900

HRA = 8082

DA = 17062

TA = 2484

So now Gross Salary will be-

Gross Salary = 44900 + 8082 + 17062 + 2484= Rs.72528/-

If he is living in Government Quarters then he will not get HRA and then his Gross Salary will be= 44900 + 17062 + 2484 = Rs.64,446/-

In this way the Gross Salary of that Employee will be either 72528/- (with HRA) or 64446/- (without HRA).

Now we come to the calculation of deductions

Deductions

As already mentioned that out of Gross Salary, Net Salary is received after some of the Deductions.

Deductions are also of two types. There are some such deductions which are deducted from the salary of all Government Employee.

There are other deductions that depend on the city in which that employee is posted. That is, they change from place to place.

First let us see what are the possible deductions. These are –

- CGHS

- CGIGS

- NPS

- LICENCE FEE

- PT

Now let us know about them one by one.

CGHS Contribution –

The full form of CGHS is- Central Government Health Scheme.

It is clear from the name that this is a health scheme under which some amount is deducted every month from the salary of the employee. Instead, the Employee gets less money for treatment in CGHS Hospital.

But this facility is not available in all cities. Therefore this deduction is not applicable to all government employees.

It depends on which city the posting of the Employee is in. If the posting of the Employee is in a city where CGHS facility is available, then this deduction is compulsorily done.

But it is also seen whether the place where the Employee is staying is in CGHS Covered Area or not. If his place of residence is in CGHS Covered Area then it will be Deduction or else not.

But the Employee whose Salary does not have this Deduction, he does not get the facility of CGHS, but he gets the facility of AMA (Authorized Medical Attendant) .

We will discuss about this in another article.

Every month deduction towards CGHS from salary of an Central Government Employee is done according to the pay level. Per month deduction under CGHS is shown in the table given below-

| Sl. No. | Pay Level of Govt. Employee | Deduction per month |

|---|---|---|

| 1 | 1 to 5 | 250 |

| 2 | 6 | 450 |

| 3 | 7 to 11 | 650 |

| 4 | 12 and above | 1000 |

Since we are taking here Basic Pay 44900/- as an example which is in Pay Level 7. In this way, the deduction from salary per month under CGHS is 650/-.

In this way the first deduction we got for our calculation is Rs 650/-.

Now let’s see the next deduction, which is CGEGIS.

CGEGIS Contribution –

Its full form is – Central Government Employee Group Insurance Scheme.

This is an insurance scheme which is provided by the Central Government.

We are not giving detailed information here because we have to learn to calculate salary in this article. So just here we will tell the amount of deduction.

The deduction that is done per month under CGEGIS is still according to the group and not according to the pay level. as written below-

Group A- Rs.120/- per month

Group B- Rs.60/- per month

Group C- Rs.30/- per month

Employees falling under Pay Level 7 are often in Group B. But in some department they are also Group C.

So in our example the deduction will be either 60/- per month or 30/- per month. Let us assume here that the deduction is getting 60/- per month.

In this way our second deduction got 60/- as CGEGIS.

Now let us see the next deduction which is NPS Contribution.

NPS Contribution –

The full form of NPS is – New Pension Scheme. This Pension Scheme is applicable from 2004 which replaced the Old Pension Scheme. The deduction under NPS is 10% of the total sum of Basic Pay and DA. In other words

NPS Contribution = (Basic Pay + DA) का 10%

= 10% of (44900/- + 17062/-)

= 10% of 61962/- = 6196/-

In this way, the deduction from salary per month under NPS is Rs.6196/-

Now the deduction after this is License Fee.

Licence Fee –

The new License Fee has been implemented from July 2020 for the employees residing in Government Quarters.

Its rate is according to the type of Government Quarters. For Type-II it is 370/- then for Type-III it is 560/-.

Employees falling under Level 7 often fall into Group B which is eligible for Type-III. If he is living in Government Quarters, then 560/- per month will be deducted from his salary.

In this way our deduction also came to know.

Now the next deduction is PT i.e. Professional Tax.

Professional Tax –

As the name suggests, it is a type of tax. It is levied on the salary of the Employee.

As the Central Government makes Income Tax Slab according to Salary, similarly the State Government collects Professional Tax according to the Income.

Since it is levied by the state governments, its rate varies. For example, two slabs have been made in Karnataka, in which there is no professional tax on income up to 15000 and 200 / – professional tax on income above this.

Similarly, Andhra Pradesh has three slabs and the maximum professional tax is 200/-. In most of the states, the maximum limit of Professional Tax is 200/- only.

So let us assume in our example that 200/- is being deducted from Salary as Professional Tax.

Apart from the above mentioned deductions, there is another deduction, that is water and maintenance charge.

It is deducted from the salary of those who stay in government quarters. Its amount varies according to the place. We are assuming that it is an average of 800/-.

So, we have got all major deductions from salary. Now we can calculate Net Salary according to Gross salary and deductions.

Hence, the Net Salary= Gross Salary – Deductions

If he has taken Government Quarter then HRA will be deducted from Gross Salary and will add License Fee and Water and Maintenance charges in Total Deductions.

So now the Gross Salary of Employee will be-

Basic Pay + DA + TA = 44900 + 17062+ 2484 = 64446/ –

And Total Deduction will increase which is- 6196+560+800 = 7556/-

So Net Salary = 64446 – 7556 = 56890/-

Conclusion

We have told in this article how to calculate the salary of a Government Employee.

For this we should know what is his Pay Level according to Pay Matrix.

On the basis of Pay Level, we can know his Basic Pay. Once Basic Pay is known, one can easily calculate HRA, DA, TA also.

On the basis of Pay Level and Basic Pay, we can also calculate the deductions from his salary. And finally can find out his Net Salary.

FAQs

How do you calculate government employee salary?

To calculate the salary of any government employee, it is necessary to know his Basic Pay. With the help of 7th CPC Pay Matrix, we can determine the Basic Pay of a government employee and after that allowances are calculated on the basis of Basic Pay. Now Gross Salary can be calculated by adding the Basic Pay and Allowances.

What is the formula for salary calculation?

Formula to calculate the salary of any government employee- Gross Salary= Basic Pay + Allowances and Net Salary = Gross Salary – necessary deductions

How to read govt pay scale?

On the basis of 7th CPC pay matrix, we can find out the pay scale of any government employee. For this, the grade pay of that employee should be known and then on that basis, we can know about the pay scale.

What is basic salary as per government rule?

The basic salary of a government employee is that on the basis of which the allowances received by him are calculated. The basic pay of that employee can be determined by the 7th CPC Pay Matrix.

What is salary matrix?

After the implementation of the 7th Central Pay Commission, the Pay Matrix was implemented in place of grade pay system. There are a total of 18 pay levels in this pay matrix. Now the salary of government employees is calculated on the basis of this pay matrix.

How do you calculate total salary from basic pay?

If the basic salary of a government employee is known, then one can easily calculate the allowances received by him. After that, to find out his total salary, his basic salary and allowances are added. In this way his total salary can be ascertained.